A New Era for Your Retirement Savings

In 2025, the Employees' Provident Fund Organisation (EPFO) is rolling out significant changes to make things easier and more efficient for its members. These aren't just minor adjustments; they're big changes designed to make managing your retirement savings much simpler. These changes will have a big impact on millions of Indian workers and how they plan for retirement. These changes will simplify PF transfers, make it easier to correct errors, provide more options for pensioners, and enhance financial security for families. These reforms represent a fundamental shift in the way EPFO interacts with its stakeholders, driven by a vision of a more user-friendly, transparent, and digitally empowered system. The overarching goal is to streamline processes, reduce bureaucratic hurdles, and ensure that every EPFO member can access and manage their retirement funds with ease and confidence.

1. Making PF Transfers Easier

Say Goodbye to Transfer Troubles!

Now, transferring your PF money when you change jobs will be a breeze! No more complicated procedures or endless paperwork.

-

Aadhaar to the Rescue: If your Aadhaar card is linked to your Universal Account Number (UAN), PF transfers will often happen automatically. This is a major move towards using technology to make things easier. Linking Aadhaar allows EPFO to quickly and easily verify your identity and transfer your funds, reducing paperwork, minimizing errors, and meaning you won't have to keep contacting your old employer. This significantly reduces the reliance on manual processes, which were prone to delays and errors.

-

Easy Example: Imagine you're switching from a company in Mumbai to one in Delhi. Previously, you'd have to fill out forms, get them signed by both your old and new employers, and maybe even visit an EPFO office. Now, with Aadhaar linked to your UAN, your PF money will likely move automatically, like your bank sending your salary to your account each month. This seamless transfer not only saves time but also eliminates the anxiety associated with the uncertainty of manual processing. In the past, employees often worried about whether their PF money would be transferred correctly and how long the process would take. With the new system, these concerns are largely mitigated.

-

Benefits Galore: This streamlined process will mean less paperwork and faster processing, which will provide greater security when you switch jobs. It will also reduce the workload for employers, allowing them to focus on their main business. Faster processing will also mean employees can access their retirement savings sooner, which improves their financial security. This means a smoother, more reliable transfer process for everyone. No more worrying about your PF money getting stuck when you change jobs!

-

Easy Example: You get a new job offer with a higher salary. In the past, it might have taken months to get your PF transferred, delaying the growth of your retirement savings. Now, the faster transfer ensures your money keeps growing without interruption. Moreover, the reduced administrative burden on employers means that HR departments can spend less time on PF-related paperwork and more time on strategic initiatives such as employee development and talent acquisition. The overall impact is a more efficient and productive ecosystem for both employees and employers.

-

2. Simplifying PF Detail Corrections

Fixing Errors Made Easy

Sometimes, there are mistakes in PF accounts, like incorrect names or dates of birth. These errors can cause problems when you try to withdraw your money or access other benefits, leading to claims being rejected or delayed. A simple misspelling can delay critical access to your funds. These seemingly minor errors can have significant repercussions, especially during times of financial need. For instance, if an employee needs to withdraw funds for a medical emergency, any discrepancy in their PF account details can lead to a rejection of their application, causing immense hardship and stress.

-

The Old Way vs. The New Way: The process for correcting these errors, traditionally known as the Joint Declaration (JD), is being significantly simplified. The EPFO recognizes that these errors, while often unintentional, can be a substantial source of anxiety and inconvenience for its members. The simplification of the JD process reflects the EPFO's commitment to enhancing the overall member experience and reducing the burden of compliance. The old JD process was often complicated and time-consuming, requiring employees to fill out many forms, get signatures from their employers, and sometimes even visit EPFO offices in person. The new, simpler process is designed to fix these issues.

-

Easy Example: Your name is "Priya Sharma," but your PF account has it as "Priya Sharmaa." Previously, you'd have to submit a form signed by your employer to get this corrected. Now, you can likely correct it yourself online. This self-service approach not only empowers employees but also reduces the administrative burden on employers, who previously had to verify and attest to the accuracy of the information provided by their employees. The online system will also incorporate validation checks to minimize the occurrence of errors in the first place.

-

-

You're in Control: Now, you can often approve corrections yourself, without needing your employer's approval. This gives you more control and allows you to fix errors quickly. Previously, employees had to rely on their employers, which often caused delays, especially if you had changed jobs or your employer wasn't very cooperative. It's like having the keys to your own PF account – you're in control!

-

Easy Example: You notice your father's name is misspelled in your PF account. Instead of waiting for your company's HR department to process the correction, you can log in to the EPFO portal and fix it yourself immediately. This direct access and control over account details will significantly improve the responsiveness of the system and reduce the turnaround time for corrections. Employees will no longer be at the mercy of their employers' schedules or administrative processes when it comes to rectifying errors in their PF accounts.

-

Time-Saving Solution: This change will save time and reduce delays. Corrections that previously took weeks can now be done in days, and some can be completed online in minutes. This is better for employees and improves the EPFO system's efficiency. Faster corrections also mean there's less chance of more errors happening. Think of it as going from snail mail to email; things get done much faster and more efficiently.

-

Easy Example: You apply for a home loan and need to withdraw some money from your PF account. Because you can correct any errors in your account quickly, you can access your funds much faster and avoid delays in your loan approval. In the past, even a minor discrepancy in your PF account could have resulted in a lengthy delay in the withdrawal process, potentially jeopardizing your loan application. The new system ensures that such delays are minimized, allowing individuals to access their funds in a timely manner for critical needs.

-

3. More Options for Pensioners

Your Pension, Your Choice

Pensioners can now receive their pension from any bank branch in India. This change gives pensioners more freedom in how they manage their money. This is a big step towards giving retirees more control over their lives. This reform recognizes the changing needs and preferences of senior citizens, who may have relocated after retirement or may prefer to bank with a particular institution for various reasons.

-

Breaking Free from Restrictions: Previously, pensioners had limited choices about which banks they could use. This caused problems, especially for those who had moved after retirement or preferred a different bank. The old system wasn't very flexible, forcing pensioners to either use multiple bank accounts or go through a complicated process to change where their pension was paid. For example, if an elderly person moved to live with their children in another state, they might have found it difficult to access their pension from a bank far away.

-

Easy Example: A retired teacher used to receive her pension in a bank in her hometown. Now that she has moved to live with her daughter in another city, she can easily switch her pension to a bank branch near her daughter's home. This newfound flexibility eliminates the need for pensioners to travel long distances or maintain accounts at multiple banks, simplifying their financial management and reducing their dependence on others.

-

-

Empowering Retirees: This change gives pensioners more control and ensures they receive their payments on time. They can choose a bank that suits their needs, whether it's closer to their home or offers better services. This is especially helpful for senior citizens. By allowing pensioners to choose their bank, EPFO is also encouraging banks to compete with each other to provide better services. This change empowers pensioners to manage their finances in the way that works best for them. It's like being able to choose which restaurant you want to eat at, rather than being told where you have to go. This freedom ensures greater convenience and peace of mind.

-

Easy Example: A retired government employee wants to take advantage of a special senior citizen account with better interest rates offered by a different bank. He can now easily switch his pension to that bank and start earning more on his savings. This ability to seek out and capitalize on better financial products and services empowers pensioners to maximize their retirement income and improve their overall financial well-being. It also fosters a more competitive banking environment, benefiting all customers.

-

4. Minimum Life Insurance Benefit

A Safety Net for Families

If an EPFO member dies within one year of joining, their family will receive a minimum insurance benefit of Rs 50,000. This provides financial security for new employees' families who may not have built up a large PF balance. This is a safety net for the families of those who are just starting their careers. This provision acknowledges the financial vulnerability of families who lose a breadwinner early in their career.

-

Support in Difficult Times: This benefit helps families during difficult times. The loss of a family's provider creates both emotional and financial challenges. This insurance provides a buffer to manage expenses and offers stability during bereavement. It can be used for funeral costs, debts, and other immediate needs, reducing financial hardship. Imagine a young family where the main wage earner has just started a new job and suddenly passes away. This benefit would help them cover immediate expenses and provide some financial stability as they adjust to this difficult situation.

-

Easy Example: A young man starts a new job to support his family. If something unfortunate happens to him within the first year, his family will receive at least Rs. 50,000 to help them through the immediate financial difficulties. This financial assistance can be crucial in helping families maintain their standard of living and avoid falling into poverty during a time of great personal loss. It can also provide them with the resources to seek professional help and support.

-

5. Counting Gaps Between Jobs

Continuity of Service

Gaps between jobs will now be counted as continuous service for calculating benefits like pension eligibility. This addresses a common issue for those who frequently change jobs. In today's world, people change jobs more often than they used to. This change recognizes that and ensures people aren't penalized for it. This reform addresses the challenges faced by modern workers who may have non-linear career paths.

-

Modernizing the System: Short breaks between jobs, like weekends or holidays, will not disqualify families from receiving benefits. This recognizes that job changes are common and ensures employees are not unfairly penalized for brief periods of unemployment. This is a more modern and realistic approach to how people work in today's world. It's like saying that if you take a short break between classes, you still get credit for the whole semester.

-

Easy Example: A software engineer works for Company A for three years, takes a month off to upgrade his skills, and then joins Company B. His service from Company A will still count towards his overall pension eligibility. This recognition of prior service, even with short breaks, ensures that employees are not disadvantaged when it comes to calculating their long-term benefits. It also encourages workers to invest in their professional development without fear of losing out on their retirement savings.

-

6. PF Withdrawals at ATMs

Your PF, at Your Fingertips

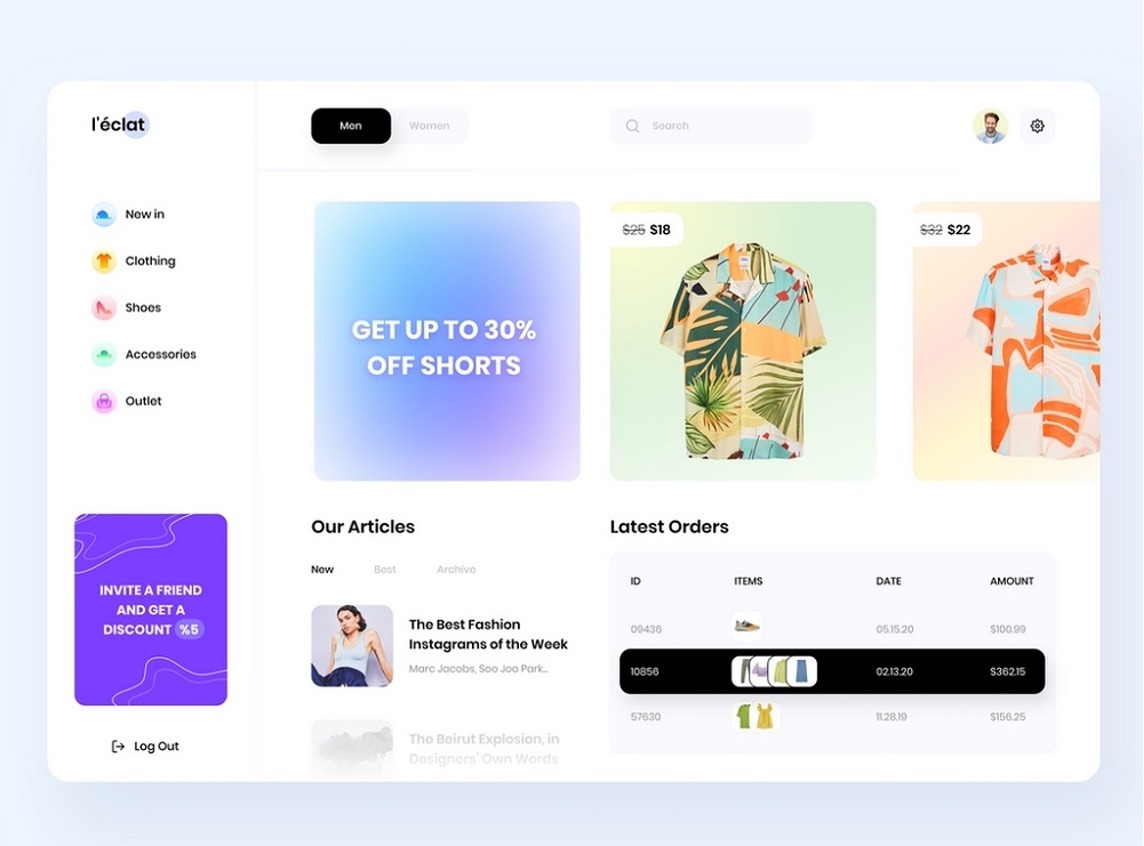

Soon, EPFO members will be able to withdraw funds directly from their PF accounts through ATMs nationwide. This uses technology to make accessing PF funds easier and more convenient. This will bring PF withdrawals into the 21st century, making them as easy as getting cash from your bank. This initiative aligns with the government's broader push towards digitalizing financial services and promoting greater financial inclusion.

-

Convenience Redefined: This will provide easy and quick access to funds, similar to withdrawing cash from a bank account. This will be helpful in emergencies and reduce the need for traditional, time-consuming withdrawal methods. It will also give individuals more control over their finances. Think about how much easier it is to get cash from an ATM than to go to a bank and fill out a withdrawal slip. The EPFO is aiming to provide that same level of convenience.

-

Easy Example: You have an unexpected medical expense and need quick access to some of your PF money. Instead of filling out forms and waiting for approval, you can simply go to the nearest ATM and withdraw the required amount. This ease of access can be a lifesaver in times of crisis, allowing individuals to meet their financial obligations without delay. It also reduces the burden on EPFO staff, who can focus on other important tasks.

-

Summary: A Brighter Future for EPFO Members

In summary, these new rules aim to:

-

Simplify Account Management: Make PF accounts easier to manage through simpler procedures and digital interfaces. This means making everything from opening an account to withdrawing funds easier and providing user-friendly online tools and mobile apps.

-

Speed Up Processes: Speed up processes like transfers and corrections. This involves using technology to automate things like fund transfers and data checks, making them faster and reducing the chance of errors.

-

Enhance Benefits and Security: Increase benefits and financial security for employees and pensioners. This includes improving pension benefits, expanding who is covered by social security, and providing more help to those who need it, like the families of deceased employees.

-

Embrace Technology: Modernize EPFO services using technology. This means investing in better computer systems, developing new software, and using things like artificial intelligence to make the EPFO work more efficiently, securely, and transparently.

The EPFO's 2025 amendments mark a significant leap towards a more secure and accessible future for Indian workers. Get ready for a simpler, faster, and more empowering experience with your PF account! These reforms are not just about improving the efficiency of the EPFO; they are about empowering Indian workers, enhancing their financial security, and promoting a more inclusive and equitable social security system. By embracing technology, simplifying procedures, and expanding benefits, the EPFO is taking concrete steps to ensure that every Indian worker can look forward to a comfortable and dignified retirement.

Additional Points to Consider:

While the document covers the major changes, here are some additional points that could be considered for even greater comprehensiveness:

-

Changes in contribution rates (if any): The document doesn't mention if there are any changes to the contribution rates by employees or employers. If there are, it would be beneficial to include those details.

-

Eligibility criteria for new benefits: For some of the new benefits, such as the minimum life insurance benefit, it would be helpful to explicitly state the eligibility criteria.

-

Grievance redressal mechanisms: Information on how members can address any issues or grievances related to the new rules could be included.

-

Awareness and education initiatives: Details about how the EPFO plans to educate members about these changes would be valuable.

Post a Comment